The rise and rise of managed accounts

Managed accounts are not new to the Australian market.

In recent times however, the appetite for these tax-efficient investment vehicles has grown with investors and financial advisers alike at last seeing their benefits thanks to:

- Changing client demands – growing desire for portfolio holdings and tax transparency

- Changing financial advice business models – fee-for-service, increasing productivity/scalability, cost pressures

- Changing technology – faster, more robust technology, full-service platforms

Efficiency gains, transparency and improving technologies are fuelling managed account growth

What are managed accounts?

“Managed accounts are tax-efficient portfolios of assets directly owned by an investor that are managed by a professional investment manager.”

A managed account can come in the form of a:

- separately managed account (SMA) (our focus)

- managed discretionary account (MDA), or

- individually managed account (IMA).

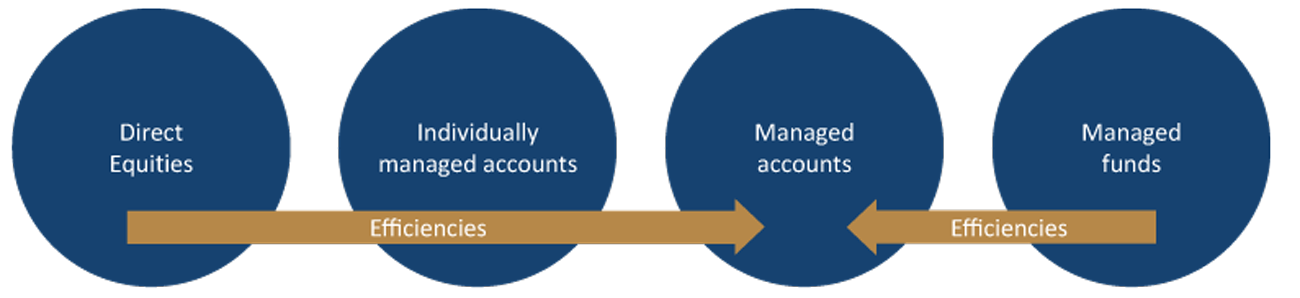

Comparing managed funds and managed accounts

While a few similarities existing between managed accounts and managed funds, they differ in some fundamental ways:

- assets within a managed account are held directly (or beneficially) by the investor, they are not pooled

- direct equity holdings can be transferred to a managed account, and

- investors are not subject to any embedded tax liability that may exist in pooled investment vehicles.

- Investor owns units

- Multiple unitholders

- Dividends, franking credits and realised gains/ losses flow directly to managed fund

- No portability (unable to transfer shares in and out)

- Unit price

- Investor owns shares

- No unitholders

- Dividends, franking credits and realised gains/ losses flow directly to investor

- Portability (able to transfer shares in and out)

- Share price

Why managed accounts?

Benefits for financial advisers

Saving time and money are some of the key benefits managed accounts deliver financial advisers.

With less administration, reporting and compliance required than direct equity investing, as an adviser you are afforded more time with your clients, can create practice efficiencies and can trade and optimise your client portfolios in a more timely way.

Benefits for investors

Some of the many benefits attracting more investors to managed accounts include: