Three investment beliefs

1. Inefficient markets

| Efficient market hypothesis | Mandelbrot |

| All relevant information is already priced into a security today |

|

| Each price change is independent of the last |

|

2. ‘Relative value’ approach

Our portfolios are typically valued biased. In most parts of the market cycle, our portfolios will display value characteristics above those of the

market.

How do we achieve this?

By comparing a stock’s current valuation to its historical valuation and to the valuation of other stocks. Our process therefore results in a

‘relative value’ (rather than absolute) biased portfolio.

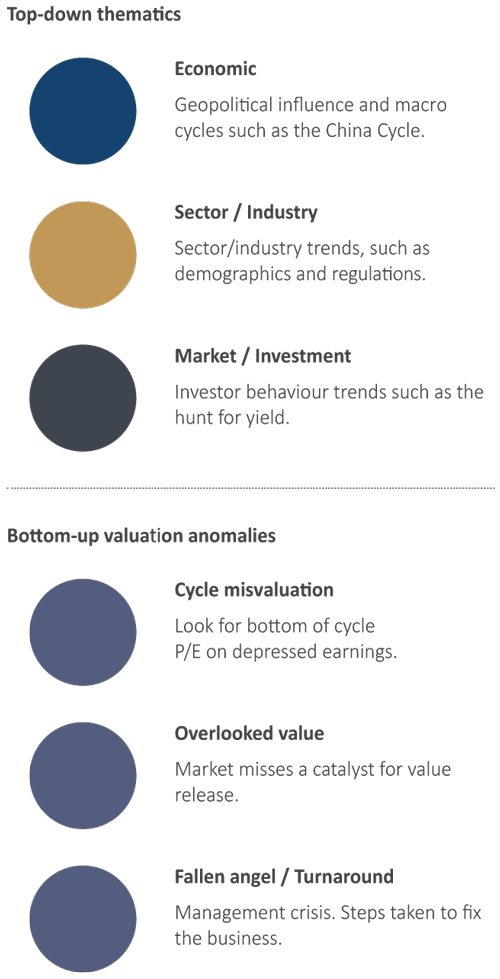

3. Top-down thematics and bottom-up research

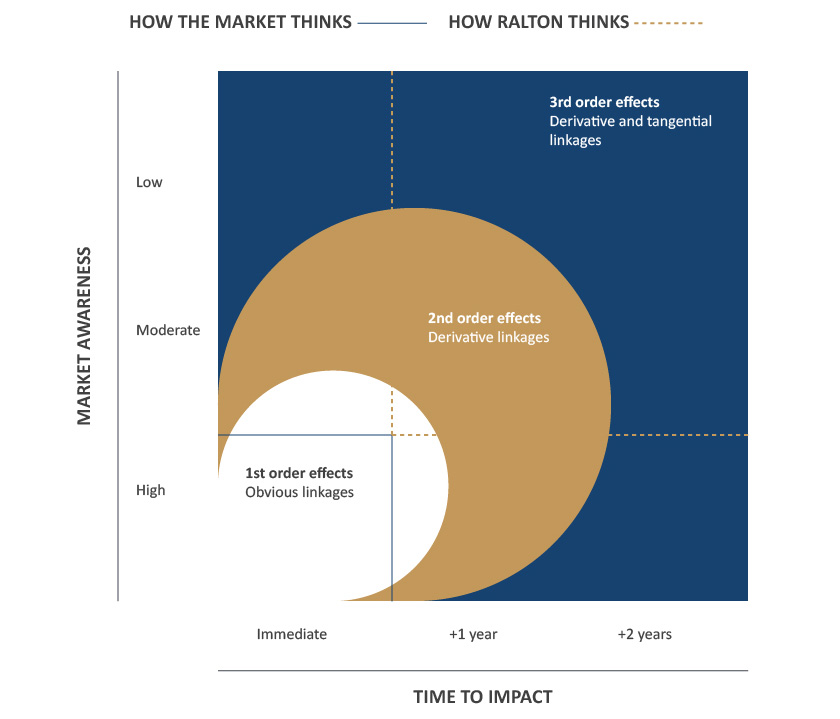

“We focus on change and we think deeply about its implications. The key change catalysts we identify are: political, economic, sector, company and market changes and their second and third-order effects. The potential impact of these effects is what informs our portfolio positioning.”

Change catalyst

- Political

- Economic

- Sector

- Company

- Market

2nd order effects

- Suppliers’ suppliers

- Competitors’ responses

- Different asset classes

3rd order effects

- Consumer responses

- Government responses

- Management behaviour

- Regulator responses